Fsa Limits 2025 Family Members. The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa. Published on december 7, 2025.

Each employee may only elect up to $3,200 in salary reductions in 2025, regardless of whether they have family members who benefit from the funds in that fsa.

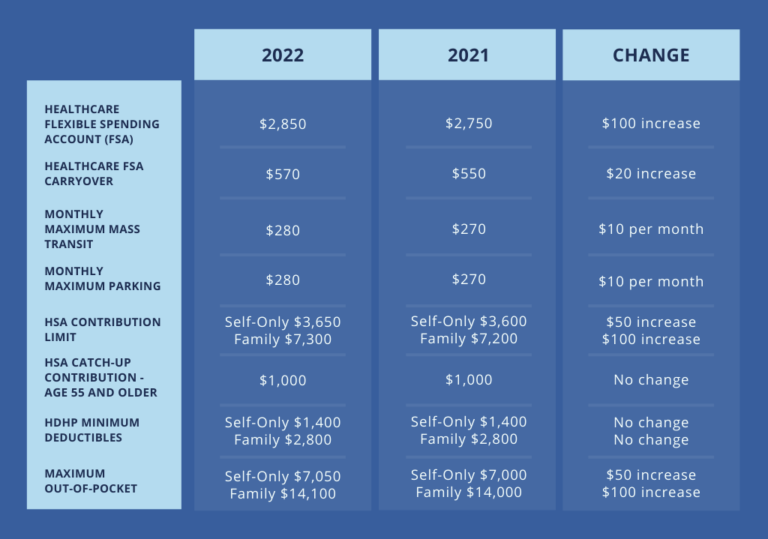

Irs Fsa Limits For 2025 Lila Magdalen, That’s up from $15,950 in 2025. The health fsa limit is $3,200 per employee in 2025, regardless of family members benefiting from the funds.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, For h.s.a.s, individuals can contribute up to $4,150 in 2025, and families can contribute up to $8,300. That’s up from $15,950 in 2025.

Social Security 2025 Limits Aili Lorine, The health fsa limit is $3,200 per employee in 2025, regardless of family members benefiting from the funds. The annual employee contribution limit will increase to $3,200 in 2025, up from $3,050 in 2025.

2025 Limits for FSA, HSA, and Commuter Benefits RMC Group, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which.

Dependent Care Fsa Limit 2025 Everything You Need To Know, The fsa contribution cap in 2025 is $3,050 and. Each employee may only elect up to $3,200 in salary reductions in 2025, regardless of whether he or she has family members who benefit from the funds in that.

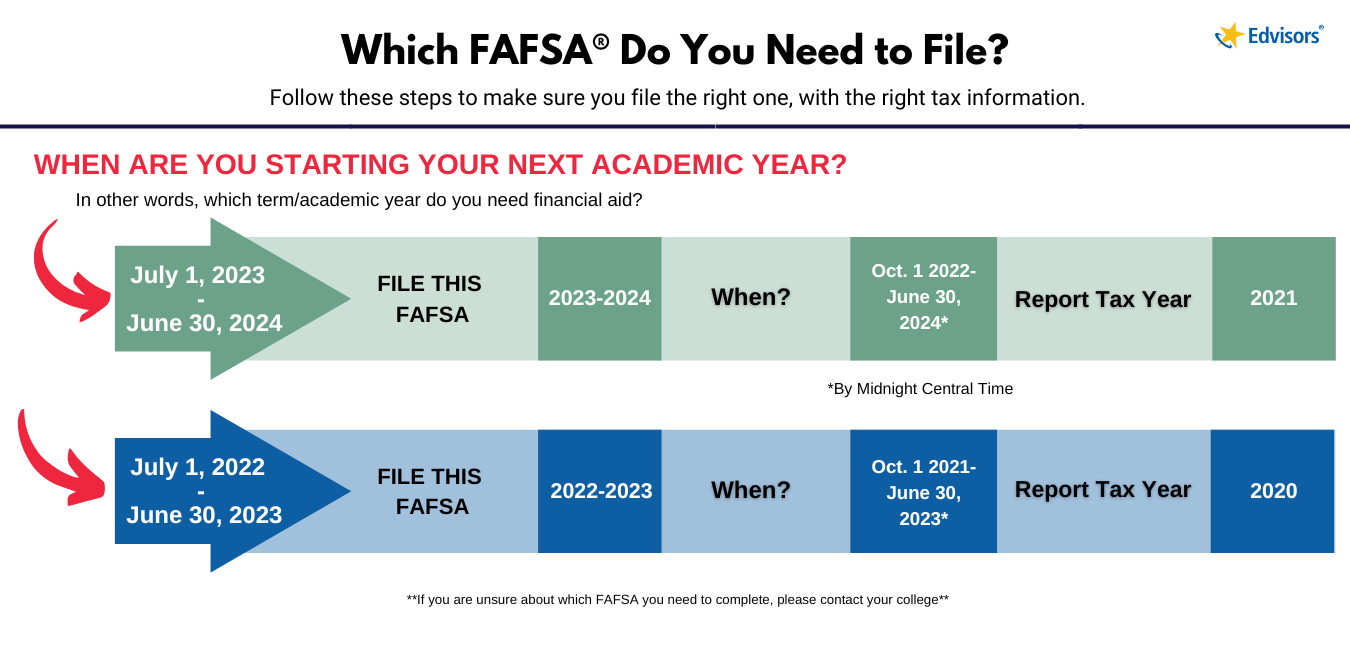

Fafsa Efc Chart 2025 Letta Olimpia, The health fsa limit is $3,200 per employee in 2025, regardless of family members benefiting from the funds. Health fsa limit increases for 2025.

2025 limits for FSA, commuter benefits, and more announced WEX Inc., The limit on health fsa carryovers increases to $640 for plan years beginning in 2025. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which.

2025 FSA limits, commuter limits, and more are now available WEX Inc., Family members benefiting from the fsa have individual limits, allowing a married couple with separate fsas to each contribute up to $3,200, subject to employer. The health fsa dollar limit increases to $3,200 for plan years.

Dependant Fsa Limits 2025 Tera Abagail, That’s up from $15,950 in 2025. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which.

2025 Inheritance Limit Flss Orsola, Each employee may only elect up to $3,200 in salary reductions in 2025, regardless of whether they have family members who benefit from the funds in that fsa. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).